Mid-Year Economic & Market Forecast

- agrisham4

- Jul 29, 2022

- 14 min read

The first half of 2022 was forgettable. Or at least, we would like to forget about it. There are many economic events taking place currently, however, that will require our attention as we head into the back half of the year:

Are we going into a recession (as officially declared by the National Bureau of Economic Research), or even more, are we already in one?

How much worse can inflation get?

When will interest rates stop going up?

Has the stock market reached a bottom / when will it recover?

…just to name a few. The resolutions of the previous questions all influence broad market movements. No doubt the volatility that has gripped markets this year is worrying to many investors, especially since we’ve been accustomed to seeing “green” on our screens following the March 2020 COVID rally. All is not lost, however, as we will discuss some silver linings which include, in our opinion, the resilient US consumer, the market taking its medicine, and the resilience of the jobs market.

Our View of The Big Picture

While there is no question the markets are in turmoil, the truth is that there is no quick fix to the situation we find ourselves in. The Federal Reserve has said it is going to raise interest rates to quell inflation, which should result in a growth slowdown or potential recession followed in time by an economic recovery. In short, we believe the US and global economies and markets need to take their medicine. It’s important to note that the stock market tends to lead the economic cycle (like it is now), so it is possible the markets can start to recover before the cycle ends. Below you’ll see our team’s recession scenarios, which break down in a 50/50 chance we see a recession in the next 6-12 months:

Muddle Along (< 2% Growth): Rates go up + no change / plateau in inflation (25%)

Soft Landing: Fed raises rates. Inflation peaks and rolls over (disinflation) (25%)

Mild Recession: Higher rates / break the back of inflation (40%)

More Severe Recession: Higher rates / break the back of inflation (10%)

While it may not be what we all want to hear, rising rates, higher inflation, and a mild-to-moderate recession scenario are critical to reset relationships amongst growth, cost of money, pricing power, profit margins, and allocation of capital. We believe we are way overdue for this reset. That said, we don’t believe that we will see a material credit crunch, banking system failure, or liquidity crisis like we’ve seen in prior downturns.

One of the most highly watched GDP reports for some time came out at the end of July and showed that the US economy contracted a second straight quarter, with real GDP shrinking by an annual rate of 0.9% following the first quarter’s 1.6% decline. No doubt much ink will be spilled by pundits, politicians, and analysts about what exactly this means for Fed policy, fiscal policy, and financial markets going forward. Suffice it to say, the advance print was below estimates gathered by Dow Jones, which saw the economy growing at 0.3%.

Per the US Bureau of Economic Analysis which released the report, “The decrease in real GDP reflected decreases in private inventory investment, residential fixed investment, federal government spending, state and local government spending, and nonresidential fixed investment that were partly offset by increases in exports and personal consumption expenditures (PCE).” The most headline-grabbing question to come out of this report is simply this, “Are we in a recession?” Though conventional wisdom holds that two consecutive quarters of GDP contractions automatically equals a recession, that is not technically the case.

Per the National Bureau of Economic Research (NBER), the body that determines recessions, “The NBER's traditional definition of a recession is that it is a significant decline in economic activity that is spread across the economy and that lasts more than a few months. The committee's view is that while each of the three criteria—depth, diffusion, and duration—needs to be met individually to some degree, extreme conditions revealed by one criterion may partially offset weaker indications from another.” According to CNBC, “likely won’t make a judgment on the period in question for months if not longer.” Where does that leave us? We won’t attempt to speculate on what the NBER will say or when they’ll make an official declaration, but we do want to draw attention to a few items we are thinking about and watching very closely.

A key silver lining we see in the overall US economy relates to jobs. With all the headlines surrounding recession, it is difficult to wrap our heads around a sustained and deep recession when today’s job market, even when accounting for plenty of negative headlines recently, is still strong in our opinion. Recent job gains maintained the strong pace as seen in previous quarters. In all, the second quarter saw job gains of around 1.12mn jobs as compared with the 1.58mn job gains recorded in the first quarter of the year. Importantly, job gains remained strong even in June as the economy was marred with impending recession headlines as seen by the labor market gaining 372k during the month vs. the 270k expected. The latest gains mean the domestic labor market has now recouped 21.5 million of the 22 million jobs lost during the pandemic, a recovery rate of 97.6%. These gains, along with the strength of the US consumer that we will discuss shortly, all add to our thesis that a recession is no sure thing, but if we do get one it would be mild in nature. In fact, it could be an unusual “recession without unemployment” due primarily to the odd nature of the post-COVID job market.

Is Inflation Getting Worse?

The latest inflation report from the Bureau of Labor and Statistics (July 13, 2022) showed that over the last 12 months, the Consumer Price Index (CPI) index increased 9.1% year-over-year. This is higher than the consensus, which was 8.8% year-over-year. What does this tell us? There were more items that saw price increases across the board: electricity costs, new/used vehicles, and even medical-care costs we all up. If the latest inflation report is any indication, the short answer is that relief may be difficult to find in the short term. However, nearly 9% of this metric consists of energy prices (source: BLS), and we have seen the price at the gas pump drop more than 5% over the last two weeks. Since June 14th, gas prices are down $0.40 on average (source: AAA/GasBuddy).

While this is only one component, it aids in our evaluation and overall view that come early fall 2022, inflation should start to peak or more likely to plateau, then start to slowly recede. That said, the decrease that could occur may be slow and gradual, and may not have the same velocity as we have seen to the upside over the last 12 months.

When Will Interest Rates Stop Going Up?

According to Bloomberg, as of late July 2022, expectations are that the Federal Reserve will continue to hike interest rates through year-end 2022. As it currently stands, markets are pricing in two-and-a-half 25 basis point hikes at the September meeting, one 25 basis point hike at the November meeting, and a 50% chance of one 25 basis point hikes at the December meeting, or four 25 basis point hikes through the end of the year. Assuming this forecast materializes, the year-end Federal Funds rate will end the year at a range of 3.25-3.50%, vs. the now current (late-July 2022) range of 2.25-2.50%. From there the expectations are generally for a pause in rate hikes, with the first cut taking place sometime during summer 2023. It’s a fair assumption that we can expect the trickle-down impact of those rate hikes to last beyond when the Fed stops because rates will still be at elevated (relative) levels. This also means that the fixed income markets are worth keeping an eye on as there may be more attractive yields than we’ve seen in quite some time. Over-reaching in the search for yield is slowly, but surely, coming to an end.

Circling back to Fed policy, we also think there is a chance that the Fed could pause its tightening cycle earlier than expected, not because inflation will disappear overnight, but because it might be a worthwhile effort to stop and observe the impact of policy implemented thus far. Keep in mind the Fed has a dual mandate—price stability AND maximum employment, and thus it is possible the Fed pauses on the first mandate to ensure they don’t completely violate the second mandate. In this case, a Federal Funds rate of 2.75-3.00% at year-end isn’t off the table.

2022 Mid-Year US Consumer Outlook

CONSUMER SUMMARY [B-]

Due to a strong labor market, increased savings balances, and some promising consumer-focused forward-looking indicators, we believe the US consumer is able to weather the inflation storm and continue to support the broader economy through spending. It should be noted, however, that this conclusion is conditional upon inflation slowing and/or plateauing in the near-term, as most analysts and our own team project. If, on the other hand, inflation continues its current trajectory or increases its rate of growth, it will spell more trouble for consumers, especially in the lower income segments. For this reason, inflation metrics and US Fed meetings must continue to be closely monitored as the Fed’s raising rate regime begins to adhere to their inflation stability mandate.

As we’ve described before, we have this basic framework for the US consumer—they will keep spending if they have a job and expect to keep their job for the next 6 months or more. Depending on which sentiment gauge is utilized, consumers either see things as ok (Conference Board), or very bad (University of Michigan). That said, we also have to acknowledge that sentiment surveys can be prone to overreaction and recency bias. If consumers generally have the ability to spend—access to credit, savings, and to a lesser degree increasing disposable income—then the wealth effect (i.e. financial asset and real estate appreciated) is more muted. With this in mind, here is how we view the US consumer in its present state.

LABOR MARKET [B+]

With layoff announcements rolling in from companies like Netflix and Carvana to JPMorgan and Redfin, the headlines can seem bleak, but unemployment continues to fall with nonfarm payrolls in June increasing by 372,000, topping the 250,000 estimate. The unemployment rate is almost where it was pre-pandemic, 3.6% in June 2022 compared to 3.5% February 2020, and down 2.4% from June 2021. This is a much more dramatic recovery as compared to what followed the 2008-2009 recession, as illustrated by Figure 1. This quick recovery, combined with a tight labor market that is currently experiencing nominal wage growth rates above 5% (Figure 2), sets the stage for a strong footing for consumers, a conclusion supported by their own outlook on the labor market.

According to the Conference Board’s July report, 50.1% of consumers said jobs were “plentiful,” down from 51.5%. On the other hand, 12.3% of consumers said jobs were “hard to get,” up from 11.6%. Overall, these marginal changes show little additional concern being placed on the workforce. As GDP growth remains low or negative, it is important to keep an eye on the labor market, as it will continue to be a major factor dictating the state of US consumer. The labor market has been seen as the bulwark against a recession, and June’s numbers combined with still high job availability expectations show that the employment pillar remains strong.

CONSUMER CONFIDENCE [C-]

On the confidence front, the University of Michigan’s Consumer Sentiment Index (UM CSI) reached an all-time low of 50 at the end of June 2022 (Figure 3A), due in part to the UM CSI’s tendency to pick up more on cost of living and consumer financial positions in light of inflation. Preliminary results for July show UM CSI rising to 51.1 though it continues to remain well below pre-pandemic numbers. The Conference Board (CB) Consumer Confidence Index (CCI) also experienced a drop as it fell more than expected in June from 103.2 to 98.7 (Figure 3B), and a further ~3 points in July to 95.7. While this certainly shows a directional shift in sentiment, this figure appears much more balanced than the record low the UM CSI displayed, thanks to CCI’s higher emphasis on the labor market.

The CB’s Forward-looking Expectations Index, based on consumers’ short-term outlook for income, business, and labor market conditions, did not fare much better. The month of July saw the index decrease from 65.8 to 65.3, its lowest level in nearly a decade (Figure 4). Consumers’ grimmer outlook was driven by increasing concerns about inflation, in particular rising gas and food prices. According to Lynn Franco, Senior Director of Economic Indicators at The Conference Board, “expectations have now fallen well below a reading of 80, suggesting weaker growth in the second half of 2022 as well as growing risk of recession by year-end.”

As consumer confidence levels drop to their lowest levels in more than a year, inflation continues to be a source of major concern for consumers, with 70% of respondents to a PEW Research Center survey (Figure 5) calling it “a very big problem”. Rising interest rates resulting from the Fed’s efforts to curb inflation mean higher financing costs for big ticket items like appliances, cars, and homes. However, despite the sagging sentiment, consumers buying plans are so far holding up, as shown by the ever-increasing Personal Consumption Expenditure index (PCE) in Figure 6. Consumer spending and economic growth will continue to face strong headwinds from further inflation and rate hikes in the near future, and while confidence remains low, we have yet to see any material demand destruction across the board, while also acknowledging that consumption reports are backwards looking.

CONSUMER SPENDING AND INFLATION [B]

For the time being, consumer spending remains well positioned in the face of mounting inflation. JPMorgan CEO Jamie Dimon said on the company’s recent quarterly earnings call, “consumers are in good shape. They're spending money, they have more income. Jobs are plentiful. They're spending 10% more than last year, almost 30% plus more than pre-COVID.” Bank of America credit and debit card data further supports this assertion, as spending rose 9% YoY in May (16% and 4%, respectively). Both are good signs for an economy that draws more than two-thirds of its economic growth from consumers.

As the backwards looking PCE index continues its rapid growth rate (good news for the economy), Q2 earnings calls hint that consumer spending is showing few signs of slowing in the near-term. For example, JPMorgan CFO Jeremy Barnum stated, “we have yet to observe a pullback in discretionary spending, including in the lower income segments, with travel and dining growing a robust 34% year-on-year overall.” While this is good news, spending data must be tempered with its ultimate effect on the consumer balance sheet as the CFO went on to say that “with spending growing faster than incomes, median deposit balances are down across income segments for the first time since the pandemic started, though cash buffers still remain elevated.”

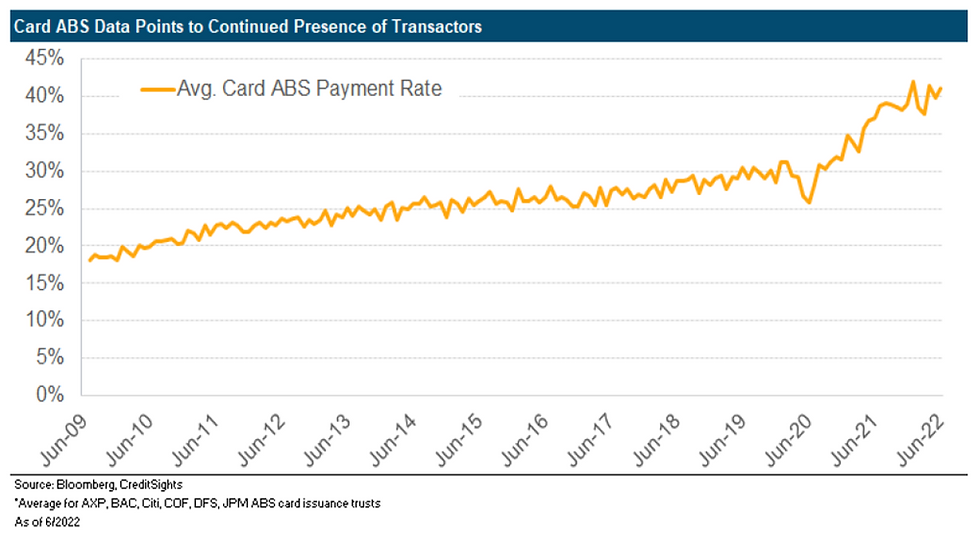

Current spending patterns’ ultimate effect on the consumer balance sheet is further supported by the spike in revolving credit as growth rates have surged YTD (Figure 7), hitting multi-decade highs. While credit usage can be viewed as a sign of financial stress on the consumer by some, it is important to analyze the underlying trends within the data. According to Bloomberg, payment rates remain meaningfully higher than historic norms, hovering around 40% as compared to around 30% pre-pandemic (Figure 8), and 30- and 90-day delinquency rates remain below pre-pandemic levels (Figure 9). Considering this and the overall spike in spending, we see the growth in consumer credit usage to be more a factor of a change in spending and saving patterns as opposed to consumers financing purchases they cannot afford.

Analysts at CreditSights concur, as their recent research suggested consumers are still sitting on significantly built-up equity from the COVID-era (stimulus + the steep drops in spending during the peak of the pandemic). This indicates the consumer can afford to maintain elevated levels of nominal spending even in the face of inflationary pressures. Furthermore, although spending growth has been turbulent over that past 6-12 months, consumers could keep spending at today’s PCE levels—nearly 20% higher than 2019—and only exhaust excess savings by mid-2023.

CONSUMER FINANCES AND SAVINGS [B]

Although consumers were slightly more pessimistic about their financial prospects as, according to the Conference Board, less consumers expect their incomes to increase while more expect their incomes to decrease, there is still support from growing personal income (PI) and disposable personal income (DPI). According to the Bureau of Economic Analysis, PI increased $113.4 billion (0.5%) in May and, DPI increased $96.5 billion (0.5%). Such increases align with what Bank of America has consistently pointed out—higher deposit balances are not limited to the high-income consumer. As of the most recent update in mid-June, BofA management estimated that for people who had savings of $1,000-$2,500 prior to the pandemic, they are sitting on balances 7x higher. For those with savings ranging from $2,500-$5,000 pre-pandemic, balances are up 5x. Wells Fargo in turn estimates median deposit balances at 1Q22 were still up ~25% compared to 2020.

While it is fair to assume that higher earners are sitting on a disproportionate share of accumulated savings, it is important to note that the bottom 60% of earners accounted for less than 40% of pre-pandemic PCE. And although lower earners may not have accumulated as much wealth as their higher earning counterparts, they still benefitted from a combination of depressed spending in 2020, means-based fiscal stimulus and other relief programs, and a tight labor market pushing wage growth up. All-in-all the historic spending data and recent credit and bank data serve to support the argument for healthier consumer financial positions across the spectrum.

Furthermore, cumulative 2-year savings are still running nearly $2 trillion higher than pre-COVID (Figure-10), a good indication that consumers are still sitting on meaningfully higher cushions and supporting nominal spend trends even as cost pressures mount. The BEA concluded that since 4Q19, aggregate non-transaction savings, money market, and retirement account deposits have grown by over $1 trillion—that’s roughly $500 bn higher than what we typically saw in the pre-pandemic expansionary period. So, while consumers rate of saving has drastically decreased, this can simply be seen as consumers de-saving as they continue to normalize their balance sheets as compared with historic norms. Even from a birds-eye view given the aggregate economy, we have a hard time believing any upcoming recession, as mild or moderate as it may be, would be enough to break the back of the consumer.

Appendix

Figure 1

Figure 2

Figure 3A – University of Michigan (Surveys of Consumers)

Figure 3B

Figure 4

Figure 5

Figure 6

Figure 7

Figure 8

Figure 9

Figure 10

Anfield Capital Management, LLC is a registered investment adviser with the SEC. This report is for informational purposes only and does not constitute advice, an offer to sell, or a solicitation of an offer to buy any securities and may not be relied upon in connection with any offer or sale of securities. The contents of this report should not be relied upon in making investment decisions. The information and statistical data contained herein have been obtained from sources that we believe to be reliable but in no way are warranted by us as to accuracy or completeness. The accompanying performance statistics are based upon historical performance and are not indicative of future performance. The types of investments discussed do not represent all the securities purchased, sold, or recommended for clients. You should not assume that investments in the securities or models identified and discussed were or will be profitable. Results of the models do not reflect the performance result of any one client. Not all clients have experienced this specific return level. Actual client returns may differ materially from the performance of the models due to actual fees incurred by clients, timing of cash flows, or client restrictions (e.g., restrictions on specific securities, industries, or types of securities). Clients who invested in the models after our initial trade date for any security may have experienced materially different performance and may have lost money.

While many of the thoughts expressed in this report are stated in a factual manner, the discussion reflects only Anfield Capital’s beliefs about the financial markets in which it invests portfolio assets following the models. The descriptions herein, are in summary form, are incomplete and do not include all the information necessary to evaluate an investment in any model. The models described represents current intentions. However, Anfield Capital may pursue any objectives, employ any techniques, or purchase any type of financial investment that it considers appropriate for the models and in the best interests of its clients.

Any prior investment results or returns are presented for illustrative purposes only and are not indicative of future returns. An investment in the models presented herein involves a high degree of risk and could result in the loss of your entire investment. Investments with Anfield are subject to significant risks, which include, but are not limited to, the risk of loss of principal, lack of diversification, volatility, and market disruptions. Prospective investors are referred to our Form ADV 2A for a more detailed discussion of risk factors, which can be (a) found on the SEC's Investment Adviser Public Disclosure website at: http://adviserinfo.sec.gov, or (b) provided upon request. You should not construe the contents of this report as legal, tax, investment, or other advice. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained herein by Anfield Capital, its employees and no liability is accepted by such persons for the accuracy of completeness of any such information or opinions. Registration as an investment adviser does not imply a certain level of skill or training and no inference to the contrary should be made.

Comments